The question of whether to rent or buy a house frequently comes up in discussions with first-time homebuyers, as well as with empty nesters. The answer is not a simple one. There are many working parts and assumptions that go into a decision such as this.

So let’s start to make assumptions on a married couple who live in Madison, WI.

- The average home price is: $300,000

- The average rent for an apartment: $1256/month

- 52% of Madison households are renters

- 48% of Madison households are owners

- The median household income of a Madison resident is: $53,933

- Approximately 30% – 40% of income is spent on either rent or a mortgage

If you would like to know how much rent you can afford based upon your monthly income and other monthly obligations, click on this rent calculator

Using this calculator for a monthly income of $4495/month with $1200 other monthly obligations (car, credit card, student loans, etc), yields a monthly rent of $1350, which is 30% of the monthly income. There are many different apartments currently in Madison that meet that criteria.

How much house can you afford? Most financial advisers agree that people should spend no more than 28 percent of their gross monthly income on housing expenses and no more than 36 percent on total debt — that includes housing as well as things like student loans, car expenses, and credit card payments.

- Mortgage payments are made up of four things: principal, interest, taxes, and insurance, collectively known as PITI.

- The rule of thumb is that you can afford a mortgage that is about 2.5 – 3 times your gross income. In the scenario of $53,933/year, that would be a house with a price of $135,000-160,000. In this case, a condo might be your best choice.

Reasons to purchase a house

- Emotional – pride of ownership

- Appreciation

- Capital Gains

- Property tax deduction

- Mortgage interest deduction

- Equity

- Community

To buy a house, you need to consider the total amount of money you would be spending over time, minus the potential value you might receive if you someday sell the property. On average, people sell a house within a 10-12 year period.

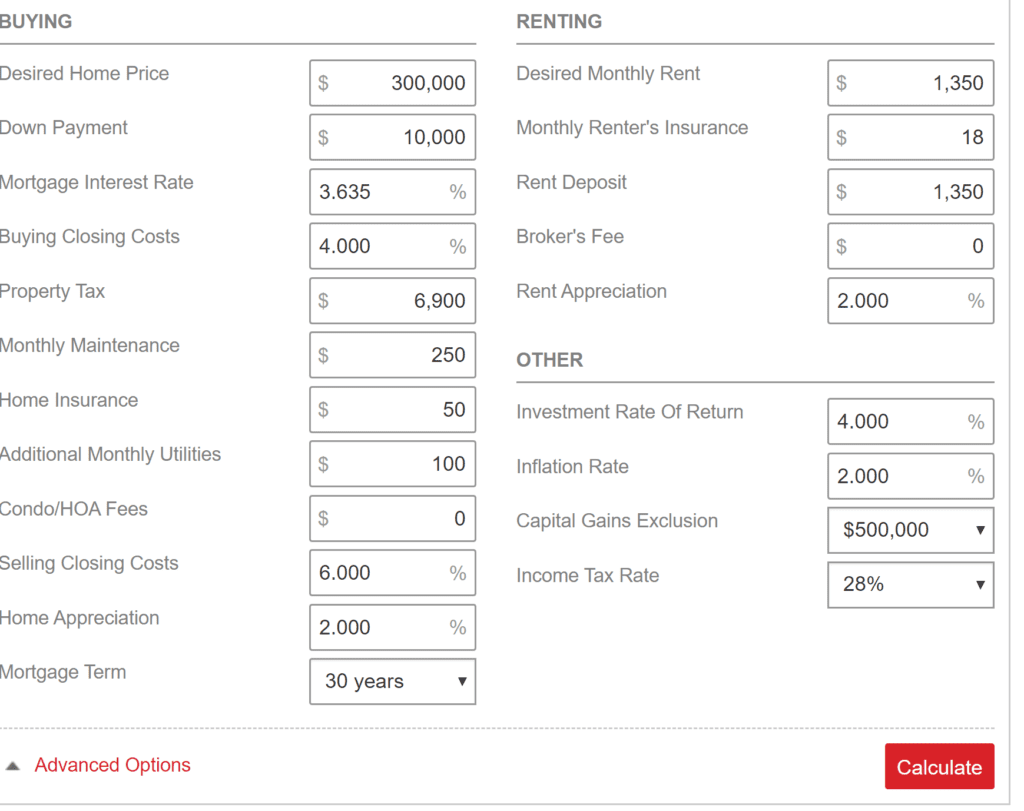

Rent v. Buy Calculations

By putting in the average purchase price of $300,000 and the average monthly rent of $1350, plus the other assumptions, gives you this calculation.

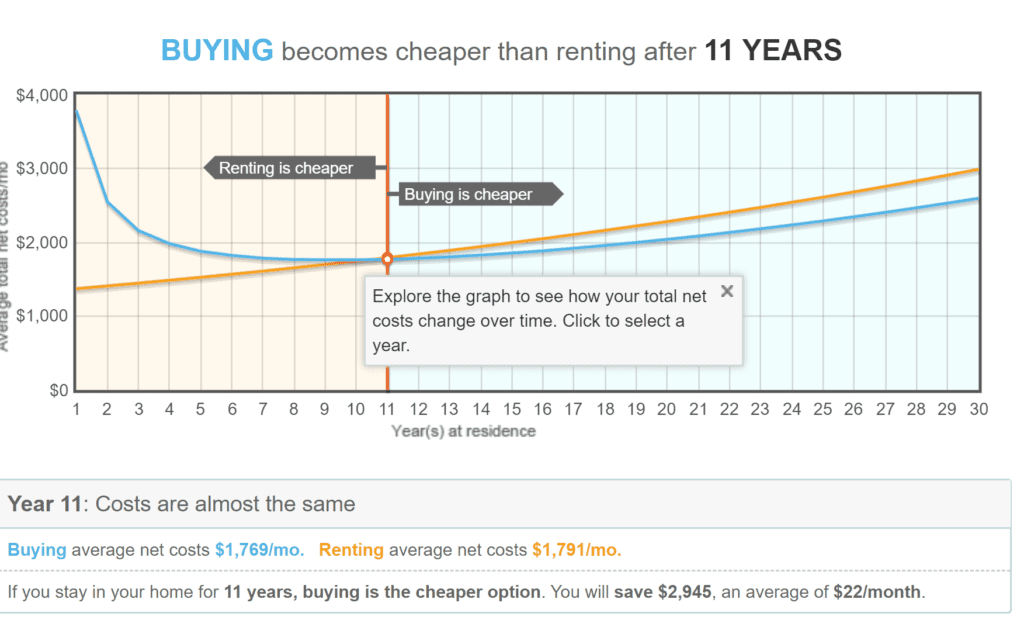

Rent v. Buy Graph

So, by looking at this graph, it may be more beneficial to rent if you are planning on making a move out of the area within a few years. However, there are many other reasons to purchase a home as stated above.

There are online calculators and spreadsheets to help you determine your best option. In my experience as a home stager and realtor, people buy houses for emotional reasons rather than purely financial reasons. I have mortgage lenders who can give you advice on how much house you can afford based upon your unique situation.

Contact me for more information and see how I can help you with your home buying or selling needs.

Gina Newell, Premiere Stagers & Realty, 608-345-9396